Should I finance my new vehicle or pay cash?

“Cash is king” is a phrase that you are probably familiar with, but when contemplating how to pay for your next large purchase, think again. Congratulations on being in the enviable position to use true cash (Money in your checking or savings account) you are doing something right!

Purchasing a brand new (or new to you) vehicle for most people is one of the largest purchases you make in your life next to a home. Naturally, you start asking yourself a million questions: “Is this a reliable vehicle?” “Is it big enough for my family and activities?” Etc, etc… One question we don’t hear in the dealership very often is: “Should I finance my new vehicle or pay cash?” Most likely discussed around the kitchen table instead, and decided before stepping foot in a dealership. Is it misinformation or distrust? I can’t say for certain, but I believe in making an educated decision and hey, if you can save money who wouldn’t want that right?

So why would you choose to take out a loan when you have cash burning a hole in your pocket? Well, if you can grow your money at a faster rate (while using the bank’s money for your vehicle) who wouldn’t want to do that?!

The logic is simple: When you can borrow money at a lower interest rate than you can earn on money you invest, it’s cheaper to take a loan than to pay cash.

I have always been a big believer in making your money work for you. Sure, saving up for a vehicle and not having payments to make every month is nice, but contrary to popular belief debt isn’t always such a negative. The wealthiest people in the world use it all the time when interest rates are favorable, yet still most people are skeptical about taking on debt no matter the situation.

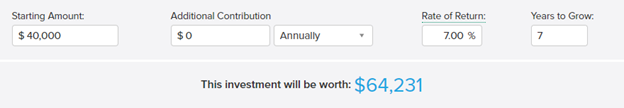

Let’s look at an example, if you take out a vehicle loan for $40,000 over 7 years (84 months) at 4.99% your cost of borrowing (interest) would be approximately $8,400. Flip side would be putting that $40,000 cash into an investment account. Even in a relatively safe balanced portfolio you can expect an average return of approximately 7%. Meaning, over that same 7-year period you would earn about $16,000. That is using a rate of 2% inflation (taking into consideration your money isn’t worth as much seven years down the road as it is today). Now you have netted a gain of roughly $7,600 without clocking in for a single day of work just taking the time to read this article.

Another benefit of financing your vehicle would be to boost your credit rating. If you continue to pay cash for purchases year after year without ever borrowing this can hinder your ability to secure financing down the road. Although it sounds weird I know, and not saying I agree with it, but I hear this comment from lenders quite often. They don’t always see your bank account details or what other assets you have in your possession. If you haven’t borrowed money and shown you can pay it back lenders tend to get leery, and it can then impact the attractiveness of terms a lender might offer. We live in a credit world and one day you may need to finance a larger purchase like a home, cottage, boat, vacation property etc. and if there is a large gap on your credit report in “lending experience” it may muddy the waters a bit for you.

Am I saying it always makes more sense to finance instead of paying cash? No definitely not, but all in all it is worth it to take the time to review the numbers. There is no secret to making more money, but to hang on to it and even have it make more money for you is where some knowledge really helps in making the right decision. In my opinion, if there is a spread of 2% or greater (interest earned versus interest paid) it makes more sense to finance rather than deplete your bank account or even worse take it out of investments.